Sell More Cars

Gain a competitive advantage to attract more buyers by offering something every customer wants: flexibility.

Customers hesitate because they fear being stuck or ending up underwater. Our product removes that fear so the desk can close more deals.

It also shortens the trade cycle since customers are no longer locked into long terms.

Boost PVR

Dealers increase PVR by around $1,000.

This is a non-cancellable front-end product for both new and used cars, whether financed or leased.

Small Effort, Big Profit

You don’t need to memorize scripts or become an expert — our materials and website provide everything.

Just introduce it early as a built-in exit option and hand the customer the info card.

The card’s QR code links to a webpage with key benefits, a short video, FAQs, and 24/7 voice and chat support that answers every question.

No pressure, no heavy selling.

No Dealer Risk

Dealers are never a guarantor or administrator. All buyback obligations are solely between us and the customer. We handle all customer support, inspections, logistics, payoff, and disposition.

The Company is backed by a Contractual Liability Insurance Policy (CLIP) issued by Plateau Casualty Insurance Company, which is rated A- (Excellent) by A.M. Best.

Non-Cancellable & No Chargebacks

Once sold, it stays sold.

Not Insurance or a Warranty

It’s a front-end add-on tied to the vehicle. No product filings or lender approval required.

How We Manage Turn-In Economics

Our diverse pool of vehicles is built on portfolio data from millions of resale transactions and third-party actuarial validation, allowing us to predict outcomes across a large, diverse mix of vehicles. We use that data to set eligibility and pricing, ensuring long-term stability and consistency. Most turn-ins are customers upgrading, not underwater exits. By managing our retail resale channels directly, we maintain consistent and predictable outcomes across the portfolio, even when individual turn-ins vary.

How the Buyback Process Works

Provide 30-Day Notice

Any time after 12 months, give 30-day notice to turn in the vehicle.

Inspection

A quick inspection confirms the vehicle’s condition.

Vehicle Payoff

We pay off the remaining lease or loan balance to the lender.

*Terms and conditions apply

FAQs

-

30-second presentation

A quick one-liner intro. No long pitch required.Customers quickly see the value

They understand the benefit instantly because it matches what they already worry about: being stuck or upside-down.The info card and QR code do the explaining

You’re not memorizing features. You’re handing a card and pointing to a QR code that explains everything.No extra steps in your process

You present it the same way as any front-end accessory. The Acknowledgment is one page and takes seconds.Works the same across new, used, lease, and finance

No mental gymnastics. No different scripts. No special rules for F&I.Customer questions get handled automatically

24/7 voice and chat take the burden off the finance desk.Most customers pre-sell themselves

Once they scan the QR code and watch the short explainer, they often come back already leaning toward yes.

-

Customers sign a one-page customer acknowledgment that explains how the program works, buyback eligibility, that it does not impact the customer’s financing terms, and confirms the dealer has no obligation, risk or responsibility for the vehicle buyback.

-

The dealer sets the retail price. We recommend $1,250 to $1,800, which adds around $20 to a 72-month loan payment or $40 to a 36-month lease payment, for example. Non-cancellable = no refunds and no chargebacks for dealers.

-

The customer loves their car today, but knows they will probably get the dashboard blues in a year or two. But on the day of purchase, they likely don't know exactly when they'll want a new car, or what their car will be worth at that time. This gives them flexibility and peace of mind — for about the cost of one takeout meal or a streaming subscription.

-

1) Customer submits 30-day notice here

2) Vehicle is inspected to confirm current condition

3) We pay off the remaining loan or lease balance per program rules.

We handle all customer support, inspections, logistics, payoff, and disposition.

Vehicle Inspection and Condition

At turn-in, the vehicle will go through our standard inspection, the same way leases and trade-ins are evaluated. It must be in clean condition, free of warning lights, and without serious mechanical issues. Normal wear is fine, but excess wear and tear or damage may reduce the buyback amount based on repair costs. The Wear and Tear Guide can be viewed at leasepass.com/wear-and-tear. Recall work and repairs must be completed. The vehicle must also have a clear title (no salvage history, branding, or unresolved liens).Mileage

There’s no mileage cap. The buyback amount is simply reduced by $0.15 per mile over (a) the prorated lease allowance, or (b) 18,000 miles per year (1,500 per month) for financed vehicles.Accidents

If the vehicle has an accident on its history report, the buyback amount may be adjusted for diminished value, just like any trade-in. Minor accidents don’t affect buyback eligibility. Only rare, severe damage that makes the car unsafe or unsellable would affect buyback eligibility.Turn-In Requirements

Turn-in requires 30 days’ notice, a current payoff statement, and a copy of the acknowledgment. The vehicle must be made available for inspection within 3 business days of giving notice and be free of unpaid tickets, tolls, or penalties that could prevent clear title transfer. -

Our diverse pool of vehicles is built on portfolio data from millions of resale transactions and third-party actuarial validation, allowing us to predict outcomes across a large, diverse mix of vehicles. We use that data to set eligibility and pricing, ensuring long-term stability and consistency.

Most turn-ins are customers upgrading, not underwater exits.

By managing our retail resale channels directly, we maintain consistent and predictable outcomes across the portfolio, even when individual turn-ins vary.

-

Dealers can boost profit and customer satisfaction, with zero risk, refund exposure, or operational burden. It applies to both new and used vehicles, whether financed via lease or loan.

The Company is backed by a Contractual Liability Insurance Policy (CLIP) issued by Plateau Casualty Insurance Company, which is rated A- (Excellent) by A.M. Best.

Non-Cancellable & No Chargebacks

Once sold, it stays sold — even if the vehicle is traded, totaled, or the deal is unwound. No refunds, reimbursements, or chargebacks.Not Insurance or a Warranty

Structured as a dealer add-on tied to the vehicle, like paint protection or theft deterrent. No licensing, product filings, or lender approval required. -

No, customers often buy our product along with GAP and VSC. It actually helps close deals faster, giving you more opportunity to present other products.

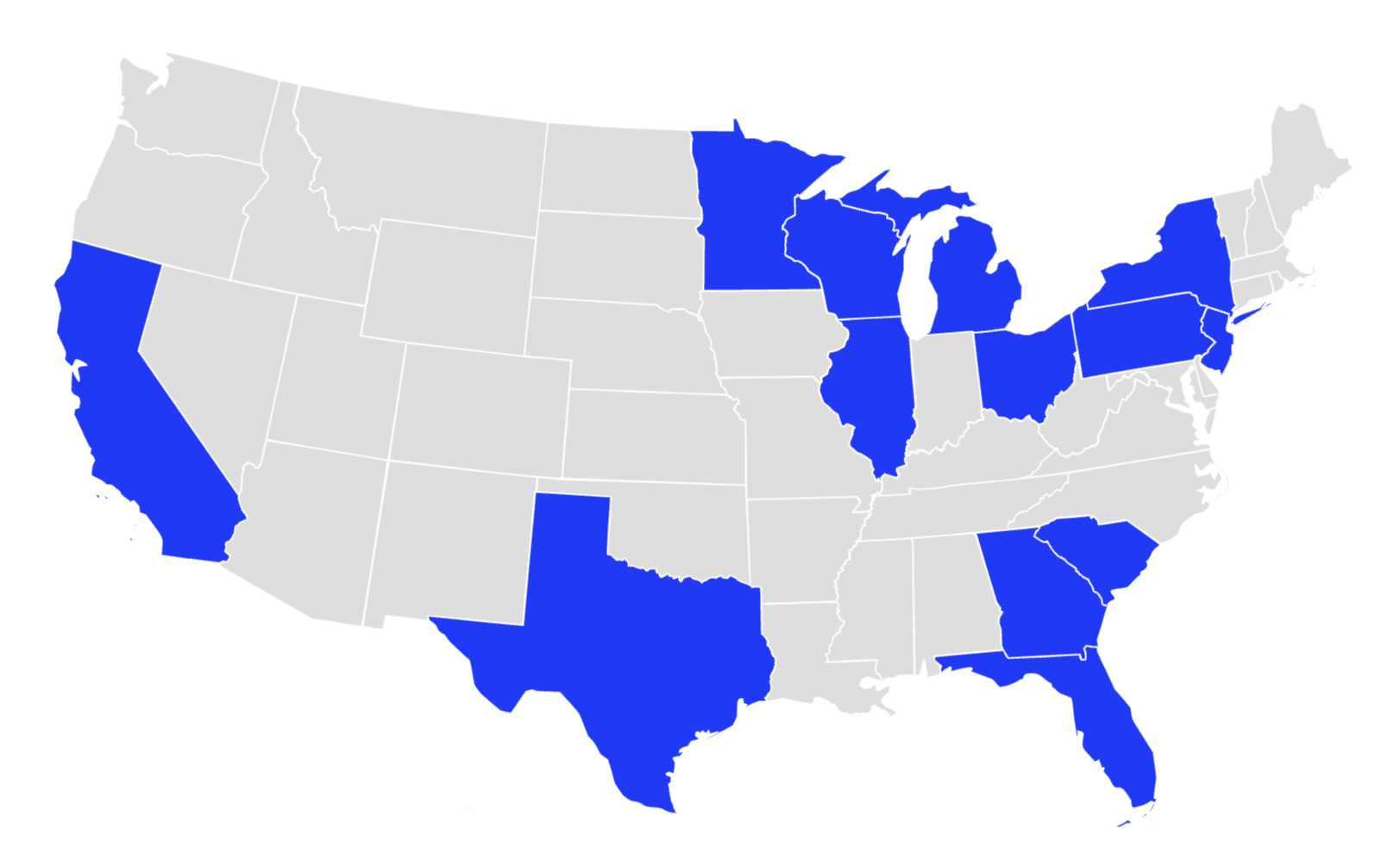

Dealers that offer this novel product stand out

Dealers are signing up after losing buyers to stores already offering it.

Customers are choosing where to buy based on who offers it.